Introduction

Growth of Lean in Financial Services

Lean’s application in services started to grow significantly in the early 2000’s, prompted by writers and practitioners, such as Michael L. George (‘Lean Six Sigma for Service’) and John Seddon (‘Freedom from Command & Control’) and Womack and Jones (‘Lean Solutions’).

In financial services, it was 2008 economic crisis that provided the real impetus for application, as companies were faced with reduced profit margins, increased competition and greater consumer demands.

Decidedly out of their comfort zones, and under pressure to develop and maintain comprehensive organisational processes, they had to consider substantial changes to the way they operated, requiring a deeper understanding of customer value and working out how these services could be optimised, delivering value for both the customer and the company.

Lean principles and methods seemed to offer a solution to the challenges faced. Profits could be improved by concentrating on services most valued by customers and costs minimised by eliminating non-adding value processes and operations.

Many financial institutions, it is argued, did not realise the full potential of Lean due to a singular focus on process redesign, rather than on a more systemic approach based around the development of a ‘Lean Management System’, central to which is an emphasis on people excellence. This encourages people to lead and contribute to their fullest potential, with robust structures to drive performance and the development of a culture of continuous improvement.

Pressures & Threats Maintained

The pressures and challenges facing Financial Services have not abated and indeed could be said to be intensifying. At the same time, emerging technologies and trends – such as robotic process automation, artificial intelligence, blockchain, big data – present significant opportunities and offer potential solutions to many of these challenges.

However, a key question to consider is how will these innovations impact on the Lean approaches now embedded in many financial services organisations and the integrity of the ‘Lean Management System’. Will they be disruptive and herald an abandonment of Lean ways of working or can they be complementary and integrate to create a more powerful force for operational effectiveness?

What is Robotics?

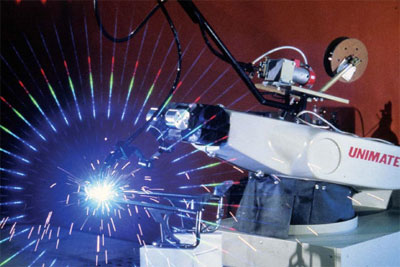

Robots are not new. In manufacturing, specifically automotive, factories first opened their doors to industrial robots in 1961, which is when Unimate joined the General Motors workforce. The Unimate robots boasted remarkable versatility for the time and could perform tasks that humans often found dangerous or boring and it could do them with consistent speed and precision.

Robots are not new. In manufacturing, specifically automotive, factories first opened their doors to industrial robots in 1961, which is when Unimate joined the General Motors workforce. The Unimate robots boasted remarkable versatility for the time and could perform tasks that humans often found dangerous or boring and it could do them with consistent speed and precision.

Ultimately, Unimate increased efficiency and eliminated further waste within the process manufacturing processes.

Automation and robots for manufacturing have come a long way since Unimate. The machines that manufacturers are using today are smaller, safer and able to perform more than a single task without expensive programming. While these innovations have significantly increased the value that automation brings to manufacturing, the latest innovations will transform the industry in ways that we have not seen since the first industrial revolution.

Just as industrial robots are now revolutionising manufacturing industries, Robotic Process Automation (RPA) “robots” are revolutionising the way we think about transforming business processes, IT support processes, workflow processes and back-office work. RPA offers dramatic improvements in accuracy and cycle time and increased productivity in transaction processing, while it elevates the nature of work by removing people from dull, repetitive tasks.

In Financial Services robotics does not, of course, involve the physical machines seen in manufacturing production lines; as the Institute for Robotic Process Automation and Artificial Intelligence puts it, RPA ‘is the application of technology that allows employees in a company to configure computer software or a “robot” to capture and interpret existing applications for processing a transaction, manipulating data, triggering responses and communicating with other digital systems.’

Today, organisations continue to invest much time and effort into understanding and applying “systems that do,” such as RPA, but the real excitement is around what is coming next, as systems that “think and learn” become more prevalent.

Whereas RPA systems can work only with structured inputs and hard-coded business rules, the next level of automation — Systems that Think — can execute processes much more dynamically than the first horizon of automation technologies.

How is Robotics being executed?

Evidence suggests that organisations are spending significant sums to assess if RPA fits their business models and processes and there is no shortage of vendors which are promising attractive savings and results. However, the focus is heavily on processes and sections of the process in the back office.

Evidence suggests that organisations are spending significant sums to assess if RPA fits their business models and processes and there is no shortage of vendors which are promising attractive savings and results. However, the focus is heavily on processes and sections of the process in the back office.

It can be argued that to measure the predicted results from RPA, a Lean diagnostic should be carried out on customer journeys at the process level versus task to identify non-value adding activity. Once identified, waste can be removed through traditional Lean levers, automation and robots.

With such a great impact on the operating environment, there are questions on how we will interact with customers and how employees will carry out work. RPA has the potential to become a trusted and dependable partner, enhancing human capabilities and creating capacity to free people from routine work, empowering them to concentrate on more creative, value-added services. This is an important point especially in view of fears about intelligent machines substituting humans and taking jobs.

With any change initiative – whether IT related or not – success should be determined on how effectively it is adopted in the organisation. Robotics is no different.

Lean & Robots

At the recent Davos World Economic Forum, business leaders and politicians stated we are at the start of a technological revolution, with great predictions for the impact of RPA. Many believe that the financial services sector must adopt RPA, but the question remains: can Lean thinking and RPA work together – are they mutually exclusive?

Given, it is suggested, that true transformation in Financial Services has only been achieved through the adoption of a Lean Management System, robotics needs to be evaluated in the context of this system and its five key building blocks:

1. Vision & Strategy

Recently, financial institutions have taken advantage of shared services, process optimisation, outsourcing and offshoring to keep costs in check. Even with these changes, margins are still tight and few companies have good control of costs, where cost problems exist and how to manage them.

When starting a Lean transformation, it is very typical to find that departments or functions do not have a clear vision or strategy, with aligned business objectives top to bottom. They often have many approaches that are meant to reduce costs, but actually end up increasing them.

Aligning strategy and vision and business objectives with RPA will give greater transparency and provide management information that will allow better strategic decisions to be made. For example, the concept of the ‘no-shore’ could be an option, where work tasks are completed where they can deliver the greatest quality for the most appropriate balanced economic benefit to meet customers’ expectations. Without alignment to strategy and vision the full RPA benefit may not be maximised, similarly, without RPA and only Lean thinking, the full potential would also not be maximised.

2. Step Change

Using Value Stream Mapping to understand the front to back process allows work to be catalogued into two key categories of value add and non-value add. This enables an understanding of where the waste is the process and the use of traditional Lean tools, such as elimination, combining, rearranging, simplifying and standardising tasks.

When thinking about how RPA can be used, a mind-set of automating activities not jobs needs to be adopted. This allows the use of RPA as an additional tool to eliminate waste.

However, the same can also be true in that no robotic solution is by its own nature Lean. One aspect that often gets overlooked is that robotic systems can speed up the creation of waste and reduce profitability, if not designed into the total system properly.

Lean is thinking out of the box – removing time, effort, and cost from the processes. Robotic applications mean flexibility in design, and capabilities—not just motion. Designing Lean robotic applications can achieve ground-breaking solutions to ordinary tasks.

3. Continuously Improve

Customers’ expectations and demands continue to evolve; delighters soon become satisfiers and the process of switching to another financial institution is now simple and incentivised.

Sustainable change is one of the key success factors of any Lean transformation and a key to sustainability is the development of a continuous improvement culture. The financial institutions that have been most successful in applying Lean thinking have taken a systemic approach to continuous improvement, characterised by:

- Delivery Management: delivery against defined customer needs.

- Performance Management: providing transparency on current versus historic performance, thereby enabling management to set direction.

- Improvement Management: using root cause problem solving to close performance gaps and achieve target conditions

RPA will be like any other tool in the Lean toolkit – the only change will be in mindset moving from continuously improving to continuously innovating, whilst introducing an agile way of working to drive a problem-solving culture. The key is to use the end-to-end principle and problem solve in multidisciplinary teams to ensure that technical solutions are integrated into classic problem solving to open up different results along the customer journey.

4. People Excellence

“The brutal fact is that about 70% of all change initiatives fail.” (Beer and Nohria, 2000)

Why? Invariably because of poor buy-in of management and staff, where there is no change in mindsets and behaviours.

Most finance transactions are strictly rule-based by nature and the tasks involve large scale data entry and data validation – and this is the type of work at which robotics excels. In addition, robots can deliver great consistency, accuracy, auditability and speed, which are essential in financial services.

Repetitive mechanical and manual routines are not only time consuming, but also error-prone when performed by humans. These tasks tend to be tedious and demotivating too. RPA can free up team members time for more challenging, meaningful work and higher value tasks involving customer service and problem solving, for instance.

Will RPA reduce the change failure rate? No, not on its own.

The digital journey is seen to offer tangible benefits by business leaders and is being even more positively embraced by their employees. From new roles, different ways of organising work, and changing work practices there are significant opportunities to humanise work, as long as business leaders reinvent their people strategies, become digital role models building stronger interpersonal skills to have the confidence to inspire a more fluid, less structured workforce and to manage the introduction of new technologies.

Above all, business leaders will need to support their teams as they learn to work with robots and as robots learn to work with them. This will involve the creation of a Digital Workforce.

5. Business Excellence

Providing the structures for driving performance is critical, linking across the Lean Management System with Key Performance Indicators (KPIs) throughout the organisation. The key proviso is, of course, if you can’t measure, you can’t improve, resulting in the Lean Management System unable to operate.

Rather than relying on existing KPIs, the overall business strategy should be used as the starting point, which allows the identification of the key drivers of performance and operational indicators. Standard definitions need to be created and measurement across the organisation ensured, cascading at every level from top to bottom.

A guiding principle of all Lean transformations is to improve the flow of service delivery in order to drive business impact measured across key KPIs and enable cost reductions. Robotics can only add to the transparency and improve the overall reporting and governance system.

Conclusion

The financial services sector has seen significant change for around a decade, with unprecedented regulatory, customer and technology challenges and increased competition as well as economic and market instability.

The financial services sector has seen significant change for around a decade, with unprecedented regulatory, customer and technology challenges and increased competition as well as economic and market instability.

This is set to continue in 2017 and beyond, with the challenges of de-regulated banking rules, Brexit, the introduction of Challenger Banks and the Fintechs. Financial organisations will therefore need to look both inwards and outwards for ways to be efficient and effective.

It appears that the financial services industry is following a path similar to manufacturing with robotics, albeit several years later, but it is certain that robots are coming.

However, it is argued that Robotics alone will not achieve the benefits predicted, but neither can Lean alone meet the expectations of this demanding market. Robots needs to be viewed as an extension of Lean thinking, with the two toolkits integrated and working together, in order for success.

But a powerful toolkit is not enough and it is contended that for RPA to deliver real benefits it must be integrated into a Lean Management System. Managers need to build and foster a culture to continuously innovate, supported by an agile way of working, bringing the right people together to operate and problem solve. Without this innovate mindset, processes, services and products will not meet future customer expectations.

It is also maintained that we will need to change how we operate and interact on a day-to-day basis, with a true understanding of the customer journey being central. It means aligning front to back and re-skilling the human workforce at all levels to work alongside new technologies, ensuring they learn to work with robots and as robots learn to work with them.

This will result in the creation of a digital workforce and in this way, robots will enable a revolution in Lean.